Step 3: Select the GST rate from the drop-down menu list Step 1: Select GST Inclusive/GST Exclusive as per the requirement Mentioned below are steps to be followed for calculating GST through GST Calculation Tool: Taxpayers who want to calculate GST with the differential GST rate can use our tool. We, at Paisabazaar offer taxpayers a dedicated and professional GST Calculator tool that helps in easy calculation of GST.

#Subtracting percentages calculators how to#

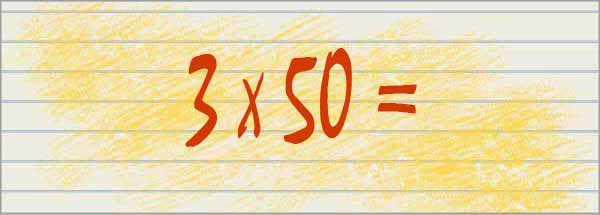

Net Price = Original Cost – GST Amount How to Use our GST Calculation Tool GST Amount = Original Cost – (Original Cost * (100 / (100 + GST% ) ) ) GST Amount = ( Original Cost * GST% ) / 100 GST Calculation Formulaįor calculating GST, a taxpayer can use the below mentioned formula : GST calculation can be explained by a simple illustration : The different slabs for GST are 5%, 12%, 18% and 28%. For calculating GST, the taxpayer should know the GST rate applicable to various categories. With the unified system of taxation, it is now possible for taxpayers to know the tax levied at different points for various goods and services under the GST regimen. Union Territory GST ( UTGST): It is collected by Union Territory Government How is GST Calculated Integrated GST ( IGST): It is collected by Central Government for inter-state transactions and imports State GST ( SGST): It is collected by State GovernmentĬentral GST ( CGST): It is collected by Central Government

Different forms of GST collected by the government are:

0 kommentar(er)

0 kommentar(er)